By Micaela Preston & Gary Gruner

Would you be willing to participate in a tax-free capital gain investment? If so, then an investment in an Opportunity Zone should be explored by your investment strategy team.

The new Opportunity Zone program offers taxpayers the possibility of three tax incentives, by investing in certain “low-income communities” through Opportunity Zone Funds. The investor benefits are:

- Temporary deferral of gains (up to eight years);

- Reduction of deferred gain (up to a 15-percent reduction); and

- Permanent exclusion on Opportunity Fund gains.

Demographics of designated Opportunity Zones include communities that have high poverty rates and have not experienced a significant socioeconomic change in the last year. In June, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) designated Opportunity Zones in all 50 states, D.C. and five U.S territories.

Georgia submitted 260 nominations from 83 counties, comprising 60 percent rural communities and 40 percent urban communities, ahead of the March 21 deadline and all were approved by the Department of the Treasury. The program will be administered by the Georgia Department of Community Affairs (DCA). Here are qualified Opportunity Zone maps for the United States.

The Ins and Outs of Opportunity Zone Investing

All the incentives relate to the tax treatment of capital gains, defined as the “gain from sale to, or exchange with, an unrelated person of any property held by the taxpayer, at the election of the tax payer.” The amount of gain invested will not be included in income for the tax year. Gains must be reinvested into the Opportunity Fund within 180 days of the original sale. Under the current Internal Revenue Code, this tax provision will expire on Dec. 31, 2026.

Taxpayers may also use mixed funds to invest in an Opportunity Fund. They’re treated as two separate investments: 1) Re-invested gains; and 2) Additional capital contributed. Only re-invested gains will receive the tax benefits found in investing in an Opportunity Fund.

The best incentives are tied to the length of an investor’s interest in a qualified Opportunity Fund―providing the most benefit to those who hold investments for 10 years or more. A qualified Opportunity Fund is an investment vehicle in which 90 percent of its assets are invested in designated Opportunity Zone property, which can be stock, a partnership interest or a tangible business property.

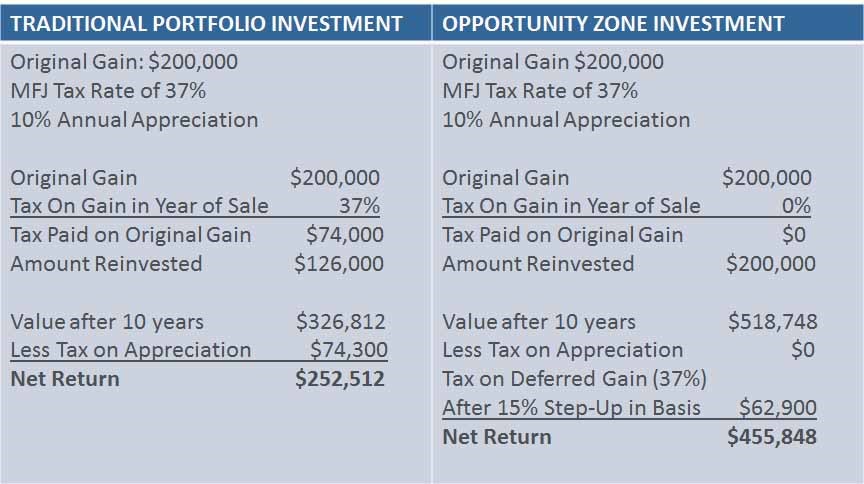

Below is an example of the type of savings an Opportunity Zone investor can realize:

Still More Guidance Needed

There are only a handful of active Opportunity Funds at this juncture. Existing Opportunity Funds are not regulated, so investors become involved at their own risk. However, additional guidance from the Treasury Department and the IRS is expected on such issues as the fund structures as well as the self-certification and self-regulations of the Funds. Currently, to become a Qualified Opportunity Fund, an eligible taxpayer self certifies. Thus, no approval or action is required by the IRS.

“Opportunity” abounds for taxpayers with large capital gains who are looking to diversify into specific real estate deals. But, patience is the best course of action until the impending guidance is issued that hopefully will address many of the gray areas the tax law itself created. However, working with your accounting firm now to start the planning process, will ensure that you’re well informed to make smart investment and tax decisions when the Opportunity Fund flood gates open.

To learn more about how you can save on capital gains through the new Opportunity Zone investments, contact Windham Brannon’s Gary Gruner at ggruner@windhambrannon.com or Micaela Preston at mpreston@windhambrannon.com.

Related Articles

Contact Windham Brannon

To learn more about what we offer, fill out the form below