No matter what industry in which you operate, your business is at risk of fraud. The AICPA Forensic and Litigation Services (FLS) Fraud Task Force recently released new fraud risk frameworks that graphically present the fraud risks faced by businesses, consumers and government entities. Within each of these three segments, the AICPA lists the most common fraud schemes.

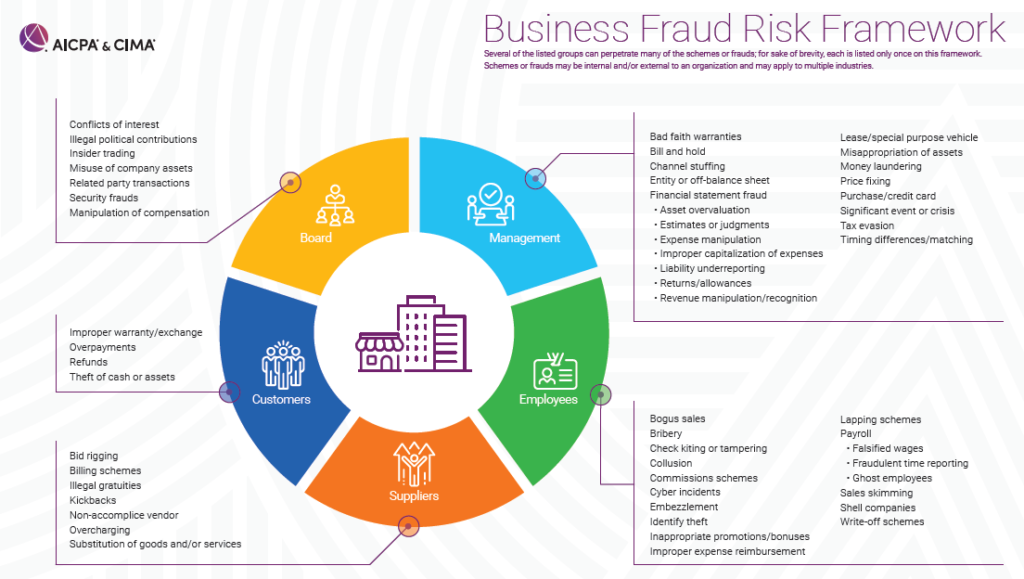

Business Fraud Risk

The business fraud risk framework breaks down the fraud schemes affecting businesses based upon the roles found in a company’s operations. Within a business’s normal activities, individuals in different roles have the opportunity to perpetrate various fraud schemes that benefit either the individual or the company. For instance, employees in certain departments have access to accounting and IT systems, assets, customers and personnel while management has the ability to potentially override the internal controls.

Businesses are at risk for many types of fraud schemes for which they need to be aware and implement preventive measures, such as strong internal controls, and also know how to expeditiously detect when fraud has occurred. Management should review the type of fraud schemes that could be perpetrated by the different roles within a business, including the board of directors, management, employees, suppliers and customers, and tailor their internal controls to prevent and detect these types of frauds.

Source: Fraud Risk Frameworks issued by the AICPA Forensic and Litigation Services (FLS) Fraud Task Force, 2021.

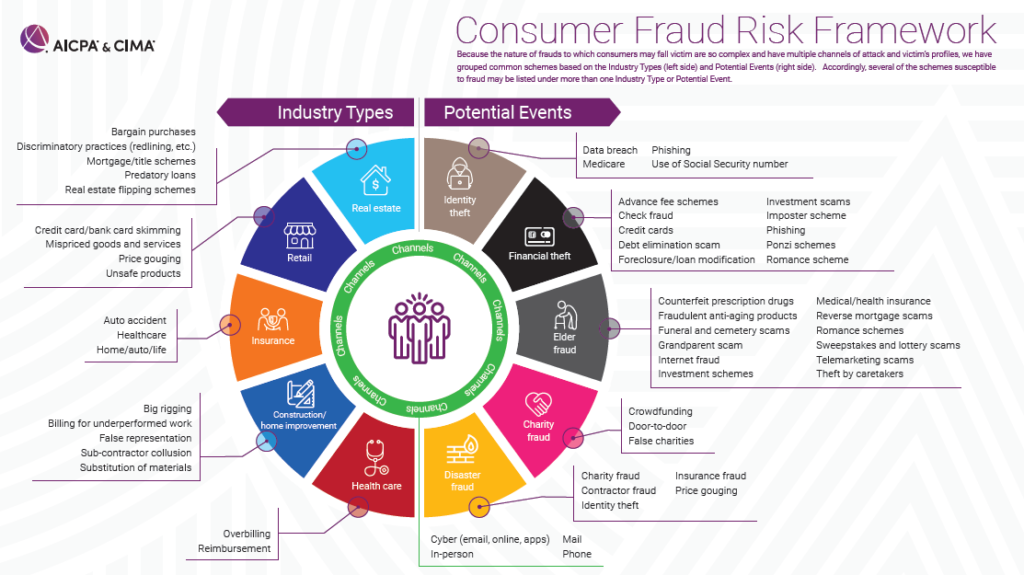

Consumer Fraud Risk

The consumer fraud risk framework groups fraud schemes based upon industry types and potential events. The AICPA identified five industries: real estate; retail; insurance; construction/home improvement; and healthcare. Each of these industries are susceptible to specific types of fraud schemes.

Some of the fraud schemes common in the real estate industry include bargain purchases, discriminatory practices, mortgage/title schemes, predatory loans, and real estate flipping schemes. According to the AICPA, “the most concentrated schemes where the business is the fraudster are: retail, financial, healthcare and charity.”

The AICPA lists potential events consumers face as risks as identity theft, financial theft, elder fraud, charity fraud, and disaster fraud. Since the onset of COVID-19, there has been a rise in the number of cases of disaster fraud, which includes fraud schemes related to charity, contractor, identity, insurance and price gouging. An example of price gouging was the surge in prices of personal protective equipment (PPE) in March of 2020.

In addition, the construction/home improvement industry has seen an increase in price gouging as costs of materials, such as lumber, plumbing fixtures, hardware, and windows, surged due to the pandemic. According to the National Association of Home Builders, in March 2021, prices for steel mill products increased by 17.6%, setting a new record high, and causing pricing volatility for these products to be greater than any time since the Great Recession.

Source: Fraud Risk Frameworks issued by the AICPA Forensic and Litigation Services (FLS) Fraud Task Force, 2021.

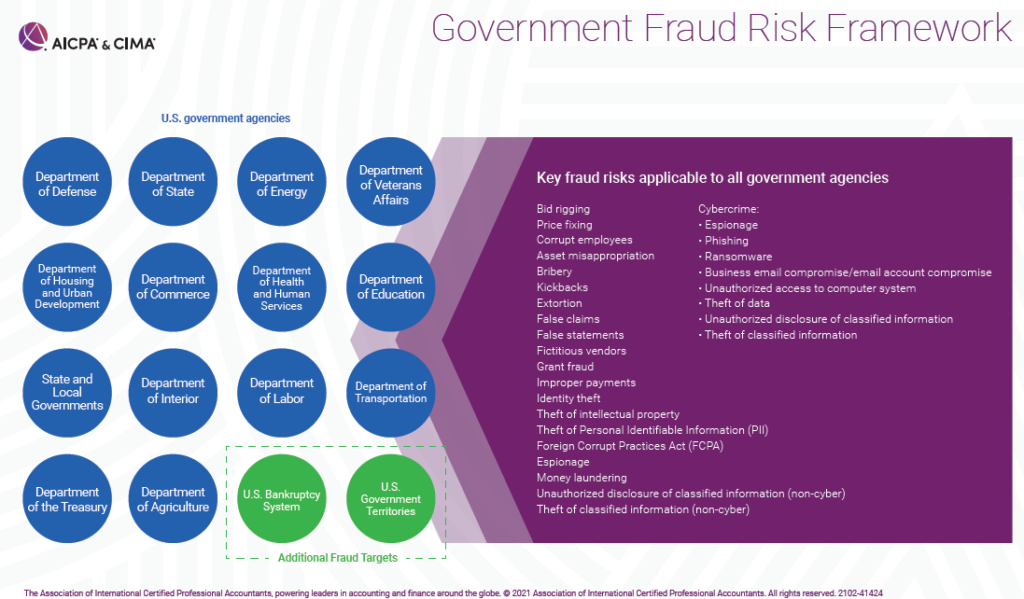

Government Fraud Risk

The last segment, government, notes each of the U.S. government agencies and lists the key fraud risks applicable to all government agencies. Businesses and government agencies share the types of fraud risks; however, often the risk faced by government agencies is much greater in terms of scale and magnitude. For instance, bid-rigging for a government contract can cost taxpayers millions of dollars due to the improper oversight and controls to prevent this type of fraud.

Source: Fraud Risk Frameworks issued by the AICPA Forensic and Litigation Services (FLS) Fraud Task Force, 2021.

If your company needs a fraud risk assessment completed, please contact Natalie Lewis to discuss. Natalie is a principal in Windham Brannon’s Forensic and Litigation Services practice and assists clients with the prevention and detection of fraud.

Related Articles

Contact Windham Brannon

To learn more about what we offer, fill out the form below